CLICK HERE TO REGISTER

Our upcoming event is now fully booked! Due to high demand, we are excited to announce an additional date on September 26, 2025. Secure your spot soon as spaces are limited.

Click here!

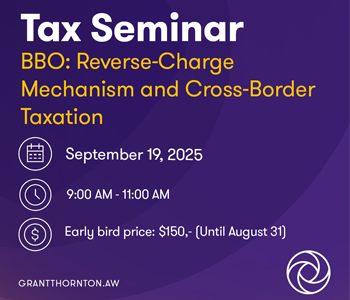

Join us on September 26, 2025, for an additional seminar designed for business owners, tax professionals, and financial advisors working with cross-border transactions.

This session will focus on the BBO (Belasting op Bedrijfsomzetten) and how the reverse-charge mechanism (verleggingsregeling) is applied in practice, particularly in international or cross-border business context.

What You’ll Learn:

- How the reverse-charge mechanism works under BBO

- Practical examples of cross-border tax scenarios

- Compliance risks and how to avoid common mistakes

- Insights into recent developments and tax authority expectations

Fee:

- $150 per person (Early Bird – valid until August 31)

- $200 per person (Regular price starting September 1)